I think most people know that schools are funded by several different taxes but probably don’t know how much money that equates to. The California budget allocated by the state government for the 2018-19 school year is “more than $2 billion in total one-time discretionary funding to schools in 2018-19” according to the state budget revision.

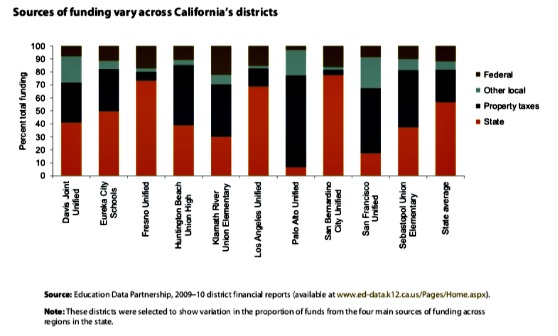

According to the Public Policy Institute of California (PPIC), several forms of revenue include: state government taxes, federal government taxes, local property taxes and other local forms of revenue. “For most of their history, California’s school districts financed their operations largely through local property taxes, with limited state and federal supplemental aid. This created large differences in per pupil funding across districts because of varying property values and tax rates. In 1971, the California Supreme Court ruled this system unconstitutional and ordered the state to equalize funding across districts. In 1978, Proposition 13 reduced the local property tax revenues available to schools, and the state had to provide even more financial support to maintain similar funding levels across districts. In 1988, voters passed Proposition 98, mandating that a minimum of roughly 40% of the state’s general fund be dedicated to education each year.”

PPIC also identified the base amount of funding that a few school districts receive in California, Fresno Unified and San Bernardino Unified receive the most state funding generated thanks to voter implemented propositions (i.e. Proposition 98, 30, and etc). Other school districts like, Palo Alto Unified and Huntington Beach Union High, receive a decent amount of funding from local property taxes. Despite the difference in budget resources varying per school district, it is clear to students, parents and teachers that the budget impacts the quality of education for students all throughout California.

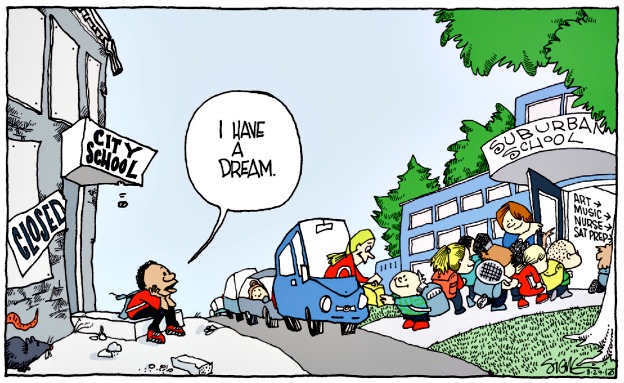

“I think that the limitations of the school budget limits viable programs that are needed to help our kids succeed. And as a parent of an African American student whose population is suffering in math and English, the budget doesn’t give them the extra resources they need to succeed,” said SBCUSD parent Kesha McGee.

SBCUSD school board member Dr. Margaret Hill added, “A school district’s budget must be designed to meet the global educational process to not only impact the quality of education but also impact the equity of education for all students. We should review our entire economic system, since my belief is the allocated ADA in all 50 states should be within a 2% range, based on the highest range.”

Therefore, the budget will always influence the resources students have. It doesn’t help that school districts with lower local property taxes are serving a large percent of low income students, whose parents often don’t have the time and money to be involved closely with their kids’ education, especially when most parents don’t have education beyond a high school diploma.